What?

CCGs (Collectible Card Games) are a genre of games that far predate mobile and social gaming, with their roots as physical card games, the most popular of which being Magic: The Gathering, Pokemon, and Yu-Gi-Oh! Although digital CCGs are nothing new, they have experienced new levels of success in the social and mobile gaming spheres.

Why?

With the excitement this year surrounding Mobage’s Rage of Bahamut and other titles, sky high revenue relative to other genres, and strong growth potential, it seemed like a good time to provide an overview on the CCG market, as we are getting increasingly more interest from clients in entering the space.

Revenue

The incredible ARPU/ARPPU of CCGs has been the catalyst for many potential market entrants. Here are some stats to give some perspective:

- According to Eiji Araki, VP of Product at GREE, CCGs monetize 8-10x better than games outside the genre

- In the first six months of 2012, Gamesbrief recorded a low of $33.37 and a high of $52.68 ARPPU in CCG-type social games across various platforms

- At GDC 2012, Kongregate claimed two of its most CCG popular titles earned monthly ARRPUs of $33.08 for Tyrant (Synapse Games) and $59.65 for Clash of the Dragons (5th Planet Games)

- By comparison, ARPPUs from mainstream social games arebetween $20 and $30 a month

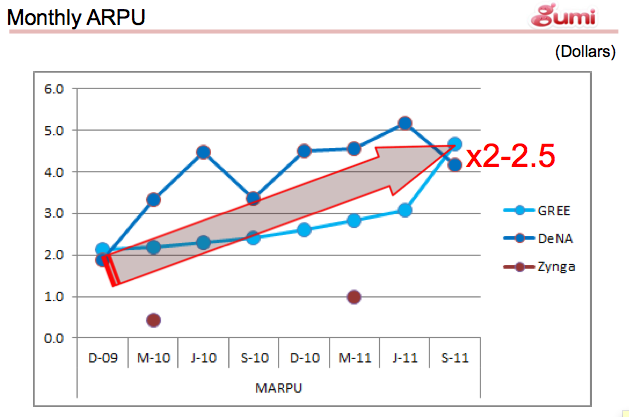

When discussing the revenue of CCGs, the influence of mystery box/gacha-style gambling mechanics cannot be forgotten – compare the ARPU of DeNA and GREE, two companies that make strong use of gambling mechanics, compared to Zynga, who doesn’t:

Source: http://techcrunch.com/2011/12/02/how-zynga-stacks-up-to-gree/

Having seen these numbers, the logical question to ask why we’re seeing such high revenue being generated. Here are at least some factors:

- Strong monetization potential, as cards, the main vehicle of player interaction in CCGs, are purchasable with many types and varieties

- PvP is inherently unfair. High-spending players have a distinct advantage over low spending cohorts. Whales that will pay to win drive up revenue averages

- As demonstrated in the graph above, gambling mechanics are a great fit for the collection-based nature of CCGs

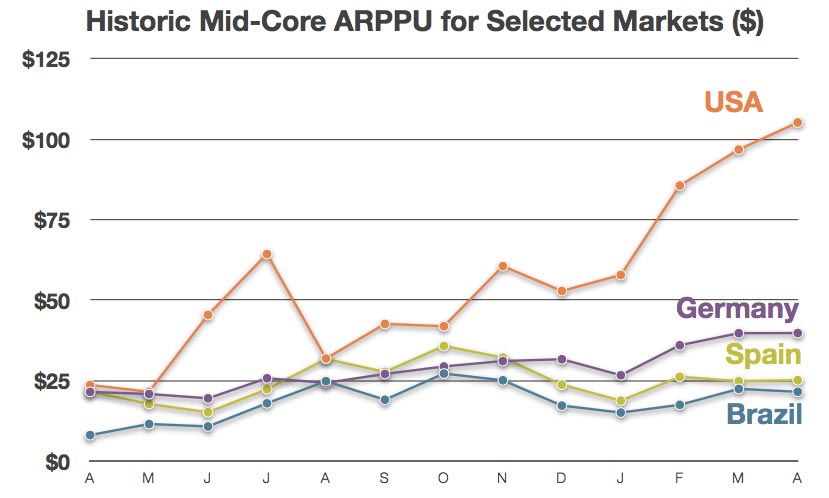

Market segmentation also plays a role in explaining this as well. CCGs mainly appeal to the growing mid-core demographic, who outspend mainstream social gamers two to one.

- According to NewZoo, it is estimated that the current potential market for mid-core games is at least $1.2 billion USD a year in the US and another $1.4 billion in key European countries

- Mid-core is expected to experience strong growth for many years

Source:

Best Practices

Based on the makeup of current popular titles, and revenue/user base data that is available, we’ve judged a number of features and practices to be effective drivers of monetization, retention, and installs.

- Guilds are excellent drivers of retention, monetization, and socialization, as there is social pressure to keep playing and spending, to maintain rankings in a competitive environment

- Tyrant, hosted on Flash portal Kongregate, 6% of users are in guilds, but that group makes up 41% of paying users

- Amazingly, ARPU for non-guild members is $0.19, vs. $3.87 for members

- PvP’s competitive gameplay naturally spurs on monetization as dedicated players will seek any advantage. This compounded with the unfair nature of CCGs (that favours high spenders) creates a never ending “arms race” between players as new cards are constantly introduced

- A regular releases of new cards in order to best leverage the strong monetization potential of PvP

- Licensed IP with a strong set of characters or a large, diverse cast (e.g Pokemon, Yu-Gi-Oh!, the upcoming Transformers game from Mobage) helps to make cards more desirable as players want to collect their favourite characters

Cautions

-

- The limited and linear nature of the genre requires strong developer commitment to a consistent roll-out of new updates to keep the game fresh and reduce churn

- Relative to other genres common to mobile and social, CCGs are complex and require strong design talent and necessary development time to ensure a balanced game

- If you are planning to focus on the pre-teen demographic, keep in mind the lack of credit cards in that group when developing a revenue model. Stored value cards are a consideration here

- Competitive art budgeting and skilled artists to make use of it are a must. To offset the visually static nature of CCGs (Rage of Bahamut is essentially a web site delivered as a native app), card art is typically very high quality. The bar has been set high for user expectations in this regard

Growth

-

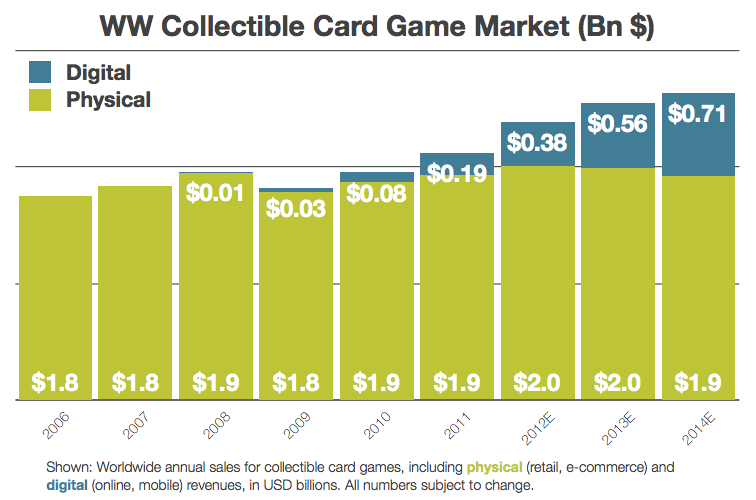

- Worldwide sales of digital CCGs are projected to grow to $0.7 billion USD annually by 2014E

- Worldwide sales of digital CCGs are projected to grow to $0.7 billion USD annually by 2014E

Source:

What is Driving this Growth?

- Declining revenue from physical CCGs as players are converting over to digital

- The vacuum in digital CCGs caused by Pokemon and Yu-Gi-Oh! not being ported over

- Powerhouse game companies are entering the space:

- EA with its array of FIFA and Madden titles

- Ubisoft with Assassin’s Creed Recollection

- Nexon just purchased Gloops, maker of several CCGs

Opportunities for Innovation

- Breadth of subject matter is relatively narrow right now – lots of room to innovate

- Continuing advances in augmented reality should help to drive CCGs as the technology is a natural fit (Eye of Judgement, Drakerz)

- Additionally, physical/digital card integrations such as California-based NukoToys’ capacitive ink technology allows physical trading cards to be scanned by touch-screens by laying the cards down on the screen, triggering actions and events in the app

- Between augmented reality, capacitive ink and unexplored content areas, there’s a tremendous opportunity for innovation in digital CCGs

Conclusion

With excellent monetization, strong projected market growth, and emerging technologies that can expand the genre, we’re very confident in digital CCGs as an exciting new territory for the mobile/social game space. If you’re interested in getting into the market, whether you are in the exploratory phase or in production, please get in touch with us.